U.S. president cites substantial progress in trade negotiations

By Bob Davis and Lingling Wei

Updated Feb. 24, 2019 9:29 p.m. ET

WASHINGTON—President Trump said Sunday he would delay an increase in tariffs on Chinese goods set to take effect at the end of this week, citing “substantial progress” on issues including intellectual property and technology transfer after a weekend of talks.

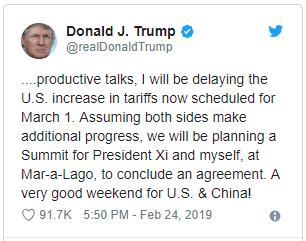

In a tweet, Mr. Trump wrote that should progress continue, the U.S. would plan a summit with President Xi Jinping of China to “conclude an agreement” that would settle a yearlong trade fight between the two nations.

Mr. Trump’s tweets didn’t specify how long the extension of a trade truce would last or any date for a potential summit.

U.S. tariffs on $200 billion of Chinese goods had been scheduled to rise to 25% from 10% at 12:01 a.m. Saturday.

In recent talks, Beijing offered to increase purchases of U.S. farm and energy products and services, ease restrictions on U.S. firms in financial services and auto manufacturing and improve protection of U.S. intellectual-property rights, according to people briefed on the discussions.

But China’s leadership sees all those measures as aligned with the nation’s own interests. Beijing so far hasn’t given much ground on issues it sees as crucial to maintaining the Communist Party’s rule, including government subsidies and support to state-owned companies and other policies that underpin its state-led economic model.

“We’re taking steps to reform state-owned enterprises to make them more competitive, just not in the way the U.S. wants us to,” a Chinese official said. The Chinese delegation is expected to leave Washington for Beijing on Monday afternoon. A statement by the official Xinhua News Agency echoed Mr. Trump’s tweets, saying negotiations were centered on putting together the text of an agreement and that “substantial progress” has been made.

Mr. Trump tweeted the progress involved “intellectual property protection, technology transfer, agriculture, services, currency, and many other issues,” without offering details.

Previously, U.S. officials had said China had agreed to a currency accord. Beijing has recently tried to keep its currency from depreciating because of fears of capital flight.

The two sides are working on a text that could top 100 pages, a person tracking the talks said.

“Trump has now substantially ratcheted up the pressure on his negotiators to strike a deal with China, even if it does little to assuage U.S. hard-liners’ concerns about China’s commitments on core structural issues,” said Cornell University China expert Eswar Prasad. “There is still a yawning gap between the two sides on major issues due to U.S. lack of trust in China’s commitments on structural issues and China’s unwillingness to make any fundamental changes to its industrial and economic strategies.”

Divisions also remain on how to address U.S. complaints that Chinese authorities and companies pressure U.S. companies to share technology. Chinese officials deny that Beijing applies such pressure and argue that foreign firms voluntarily share technology in exchange for access to China’s markets.

U.S. semiconductor, chemical and auto firms, in particular, complain that Beijing has a variety of ways to obtain U.S. technology, including by joint-venture requirements and by regulatory panels that pass along U.S. technology secrets to Chinese firms.

During the latest round of trade talks, said the people briefed on the matter, Chinese negotiators said Beijing was willing to better police practices on the local level and encourage U.S. businesses operating in China to report coercion to regulators. U.S. negotiators are pushing for much broader changes.

“If extending the deadline leads the two governments to secure a sustaining bilateral deal that addresses American concerns about market access and structural reforms, then it will be worth it,” said Myron Brilliant, executive vice president at the U.S. Chamber of Commerce. “Business wants a comprehensive deal that will reduce tensions and eliminate existing punitive tariffs.”

The two sides also haven’t agreed how to enforce any deal. U.S. officials, who have for years complained about China’s poor follow-up record, are pushing for provisions that would either permit Washington to reimpose tariffs on Chinese goods should Beijing fail to meet certain milestones—called “snapback” in trade lingo—or leave the levies in place and gradually remove them if Beijing meets agreed-upon yardsticks.

Chinese officials have criticized that approach as unfair, and they said the two sides should jointly evaluate complaints.

Another issue: what standards should be used to judge compliance with an accord. If one or two U.S. firms continue to have intellectual-property problems in China, for instance, should that be sufficient to reimpose tariffs? If that isn’t sufficient, what is?

Hudson Institute China scholar Michael Pillsbury, who advises the Trump trade team, said the president hoped to get a negotiating edge by having a summit meeting in the U.S., rather than China.

In past negotiations with the U.S., he said, China has reserved its most significant concessions for a final meeting with a U.S. president. But some in the White House worry that Mr. Trump will be so committed to getting a deal that he will settle for a weak agreement.

Some Chinese officials said the U.S. underestimates the domestic political problems facing Beijing given the growing nationalist feeling at home.

The two sides are working off a lengthy list of U.S. demands on trade, delivered to Beijing last May, that includes cutting the bilateral trade imbalance by $200 billion in two years and halting subsides for advanced technologies. Many Chinese have compared those demands to the infamous “21 Demands” made by Japan in 1915 that would have greatly extended Japan’s control of the Chinese economy during World War I.

Mr. Trump has made cutting a trade deal with China a priority. His top trade negotiator, Robert Lighthizer, has long taken a hard line on Chinese trade practices—and in recent weeks has been cautioning about the big hurdles that remain before the two sides can strike a deal. Mr. Lighthizer has focused on so-called structural issues, including subsidies and technology transfer.

Major stock indexes in Shanghai and Shenzhen each jumped more than 2% in early trading on Monday. The gains followed the signs of progress in trade talks, as well as comments from President Xi Jinping, reported in state media over the weekend, that finance should play a bigger role in the economy.

—Shen Hong in Shanghai contributed to this article.

Write to Bob Davis at [email protected] and Lingling Wei at [email protected]

Appeared in the February 25, 2019, print edition as ‘U.S. Will Hold Off On China Tariffs.’