Panama Canal restrictions are rerouting LPG shipping flows

Panama Canal restrictions are already forcing ships to take multi-week detours via the Suez Canal and Cape of Good Hope. One shipping segment is more exposed to these reroutings than any other: specialized tankers that carry liquefied petroleum gas (LPG) from the U.S. to Asia.

America is the world’s largest exporter of LPG, i.e., propane and butane. Since the Neopanamax locks opened in 2016, the vast majority of U.S. LPG exports to Asia have been loaded on very large gas carriers (VLGCs) and sent through the Panama Canal. (VLGCs were too large to fit in the older Panamax locks.)

Canal congestion has arisen periodically over the years, but today’s situation — involving an extreme drought — is different and could cause a lasting shift in VLGC flows away from Panama, according to Oystein Kalleklev, CEO of Avance Gas (Oslo: AGAS).

“We usually see congestion more or less every year in the fourth quarter. Now we’re already seeing it in August,” said Kalleklev during a conference call on Wednesday.

“Of course, the rainfall will come back, but with the congestion, [VLGC] traffic will go up in Q4, so we don’t see any improvement near-term. I think we’ll see a clogged canal for the rest of Q3 and into Q4 and it will probably taper off sometime next year.”

Congestion at canal to persist

“There is also the discussion about climate change and whether the canal is more vulnerable in the future. A lot of people are making that argument,” he said.

Meanwhile, the volume of LPG transported from the U.S. to Asia is expected to continue rising in line with increased U.S. production, creating even more demand for canal transit slots. U.S. LPG exports in January-August rose 10% year on year.https://7d6dfb5622e7e1cea346eee162772076.safeframe.googlesyndication.com/safeframe/1-0-40/html/container.html

“This trade is expanding,” said Kalleklev, who noted that “America is also expanding a lot on the LNG side.” Liquefied natural gas carriers compete with LPG carriers for Neopanamax transit slots.

“It’s not really any surprise that the canal has been clogging up pretty much every Q4 for the last couple of years, because when they first expanded the canal, it was done to facilitate bigger container ships and all the trade from China to America. Nobody was thinking at that time that America would become the biggest LNG and LPG exporter in the world. The canal was never scaled to this kind of trade — and on top of that, we now have this very big drought.”

If the Neopanamax locks cannot handle all the container ships, LNG ships, passenger ships and LPG ships that want to transit, it’s the LPG ships that get stuck at the back of the queue, said Kallaklev.

“There is precedence given to cruise ships, container ships and LNG ships that have more valuable cargo than LPG ships. So, you will probably see fewer VLGCs transiting through Panama going forward than in the past.”

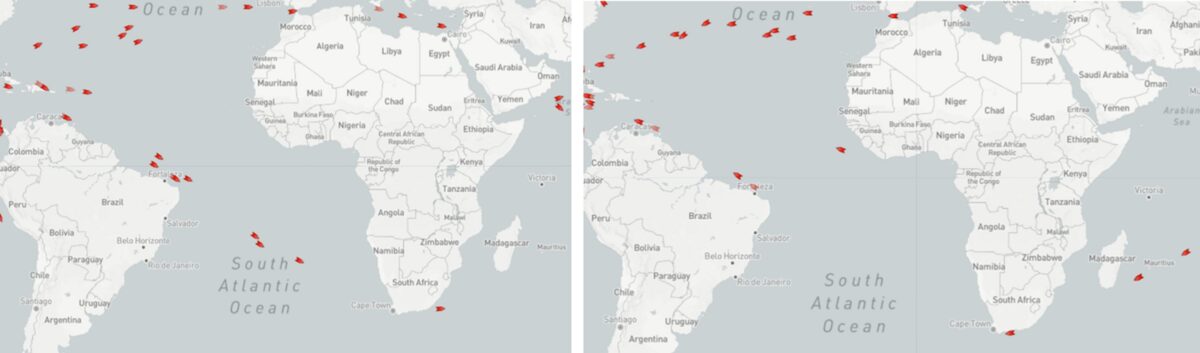

How canal uncertainty affects LPG ship routing

A U.S.-China VLGC voyage takes 58 days round trip via the Panama Canal, 81 days via the Suez Canal and 88 days around the Cape of Good Hope, according to Avance.

The trade is heavily focused on spot deals. After a VLGC unloads in Asia, the shipowner seeks to lock in the next deal as the vessel returns empty, i.e., “in ballast.” If an employment agreement (a “fixture”) is reached, it will include a “laycan” — a period of time when the ship must be available to pick up the cargo.

The problem for VLGCs heading back to the U.S. is that Panama Canal waiting time is now extremely volatile, making laycans more difficult to hit, and spot rates are very high, adding urgency to maintaining schedules.

“The Panama Canal is a bit of a bingo. Sometimes you can go straight through, other times you have to wait for a week or two,” said Niels Rigault, executive vice president at BW LPG (Oslo: BWLPG), during a conference call Tuesday.

“We also see that when the Panama Canal opens up for [transit slot] auctions, the price some VLGC owners are willing to pay just to pass through the Panama Canal for one leg is up to $2 million,” added Rigault.

According to Kalleklev, “Waiting time is very sporadic. If you discharge a cargo and fix a ship for the U.S., you don’t know if the waiting time will be two days, five days, 10 days or 20 days.

“If it suddenly goes up, which happens quite a lot, and you have fixed your cargo with a two-day laycan and you don’t make it, you will be dropped, and then you’ll be ballasting on your own account and will have to fix the ship again.

“A lot of people would rather just go through the Suez, or if fuel prices are low, they might go around the Cape of Good Hope to avoid the Suez Canal fee.

“You can also skip the queue by winning an auction, but it is immensely costly. People are paying top dollar. We’ve seen the numbers go to $1 million, then $1.5 million, then last week we saw someone pay $2.4 million for an auction fee.” (All of the recent bids topping $1 million have been for Pacific-to-Atlantic transits on ballast legs.)

“When you add that to the regular fee of close to $400,000, the cost of getting your ship through the canal is close to $3 million. You would have saved a lot of money just going through the Suez or around the Cape of Good Hope instead.”

Spot rates, stock prices rising

The more VLGCs that detour around the Panama Canal, the higher the demand for VLGCs measured in ton-miles (volume multiplied by distance). Higher ton-mile demand is a positive for spot rates.

The Panama Canal effect is supporting rates on top of already strong transport demand. VLGC spot rates are currently more than double normal levels for this time of year.

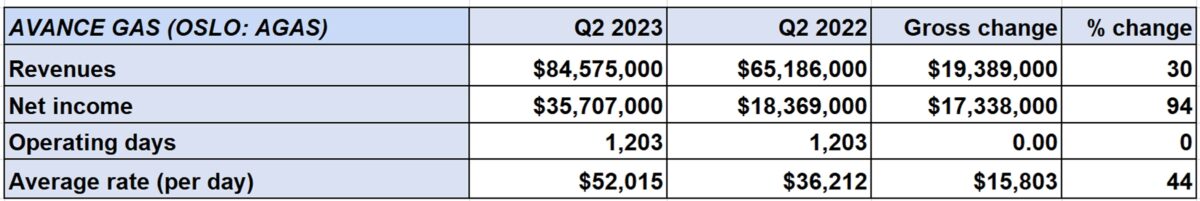

Stocks of VLGC owners have been star performers over the past year. Among the three listed VLGC owners, shares of Avance have doubled year on year. Shares of BW LPG — which announced Tuesday that it will obtain a U.S. listing to complement its Oslo listing — are up 83%. Shares of Connecticut-based Dorian LPG (NYSE: LPG) are up 63%.

VLGC spot rates are currently $78,400 per day on a round-trip basis from the Middle East to Asia. Rates are $93,500 per day from the U.S. to Asia “but that’s only the case if you have a perfect voyage that goes straight through the canal, which for the most part is not the case today,” said Kalleklev.

The longer distance of the Suez route significantly increases fuel costs, which brings down the net U.S.-Asia rate via the Suez route to around $80,000 per day, in line with the Middle East-Asia route, he noted.

Spot rates are heavily driven by arbitrage: the difference between the price of LPG where it’s produced, in the U.S., and where it’s sold, in Asia. “As of today, LPG is super-cheap in the U.S., driven by very high inventory levels … while demand is strong in Asia,” said Kalleklev.

The price of LPG is currently $275 per ton more expensive in Asia than in the U.S. The transport cost is $175 per ton. That leaves $100 per ton. The average VLGC holds 45,000 tons, equating to a profit of $4.5 million on a single voyage.

“It’s immensely profitable to move our cargo from the U.S. to Asia — and that means you can also pay higher freight,” said Kalleklev.